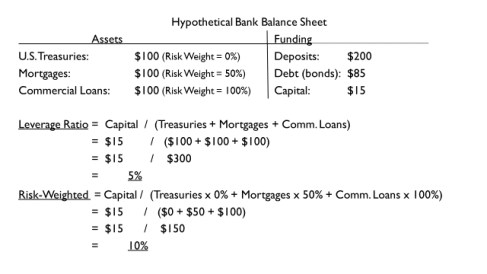

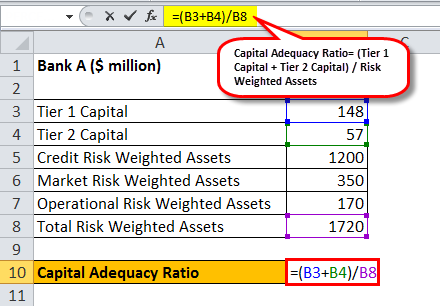

Reserve Bank of India Deputy Governor N. S. Vishwanathan has defended the central bank's decision to stick to stiffer capital adequacy ratio (CAR).

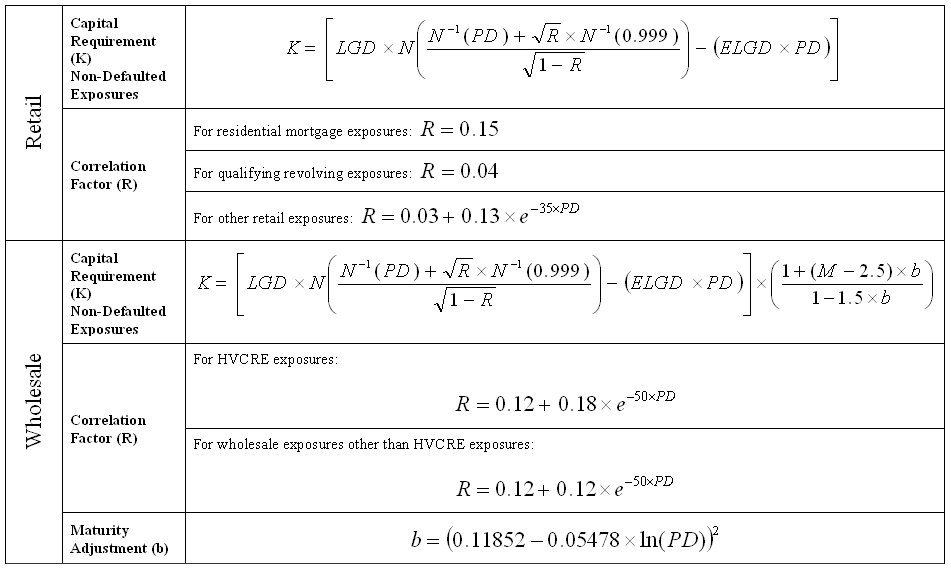

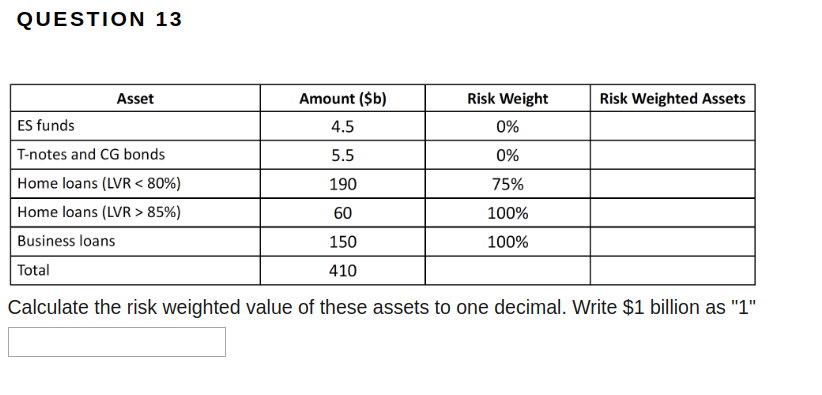

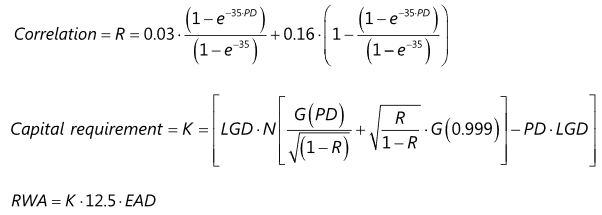

FDIC: FIL-86-2006: Proposed Rule on Risk-Based Capital Standards: Advanced Capital Adequacy Framework

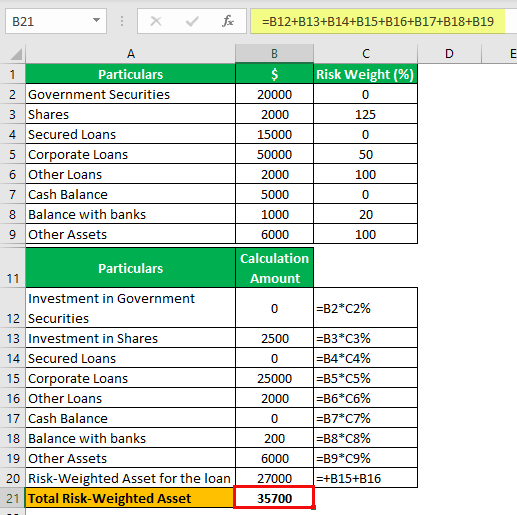

Dheeraj on Twitter: "Risk-Weighted Asset Definition (Formula, Examples) | Advantages https://t.co/t8U4glNhIR #RiskWeightedAssetDefinition https://t.co/LxE9ToypeP" / Twitter

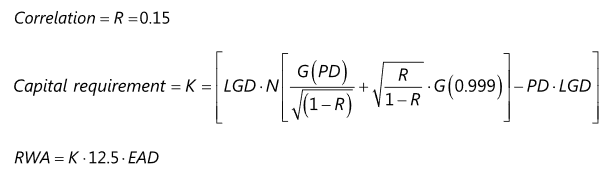

:max_bytes(150000):strip_icc()/riskweightedassets.asp-final-752d387734924e54871f7f69f150bdbe.png)